Stonewell Bookkeeping Fundamentals Explained

Wiki Article

The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

Table of ContentsThe 6-Second Trick For Stonewell BookkeepingThe Greatest Guide To Stonewell BookkeepingStonewell Bookkeeping Things To Know Before You Get ThisA Biased View of Stonewell BookkeepingStonewell Bookkeeping Can Be Fun For Everyone

Rather of going through a filing cupboard of various records, invoices, and receipts, you can provide thorough documents to your accountant. After using your accountancy to submit your tax obligations, the IRS may select to execute an audit.

That financing can come in the type of owner's equity, gives, organization lendings, and capitalists. Financiers require to have an excellent concept of your business before investing. If you don't have bookkeeping records, capitalists can not establish the success or failing of your firm. They require current, accurate info. And, that info needs to be readily easily accessible.

The Only Guide to Stonewell Bookkeeping

This is not meant as legal advice; for even more info, please click here..

We responded to, "well, in order to know how much you require to be paying, we need to know just how much you're making. What are your earnings like? What is your earnings? Are you in any financial debt?" There was a long time out. "Well, I have $179,000 in my account, so I presume my earnings (incomes much less costs) is $18K".

Stonewell Bookkeeping Can Be Fun For Anyone

While it might be that they have $18K in the account (and also that might not hold true), your balance in the bank does not always establish your profit. If somebody obtained a grant or a financing, those funds are not thought about profits. And they would certainly not infiltrate your revenue declaration in establishing your earnings.

While it might be that they have $18K in the account (and also that might not hold true), your balance in the bank does not always establish your profit. If somebody obtained a grant or a financing, those funds are not thought about profits. And they would certainly not infiltrate your revenue declaration in establishing your earnings.Several things that you think are expenses and deductions are in reality neither. Accounting is the procedure of recording, classifying, and organizing a company's financial deals and tax obligation filings.

An effective business needs help from professionals. With practical goals and a qualified accountant, you can quickly resolve challenges and keep those concerns at bay. We commit our power to ensuring you have a solid monetary structure for development.

Getting The Stonewell Bookkeeping To Work

Exact accounting is the backbone of good financial monitoring in any type of company. With good accounting, companies can make better choices since clear financial documents use valuable information that can assist technique and boost revenues.On the other hand, solid accounting makes it simpler to safeguard financing. Exact financial declarations build count on with lending institutions and investors, enhancing your chances of getting the resources you require to grow. To preserve solid financial health, services should frequently reconcile their accounts. This suggests matching purchases with bank statements to capture errors and stay clear of financial disparities.

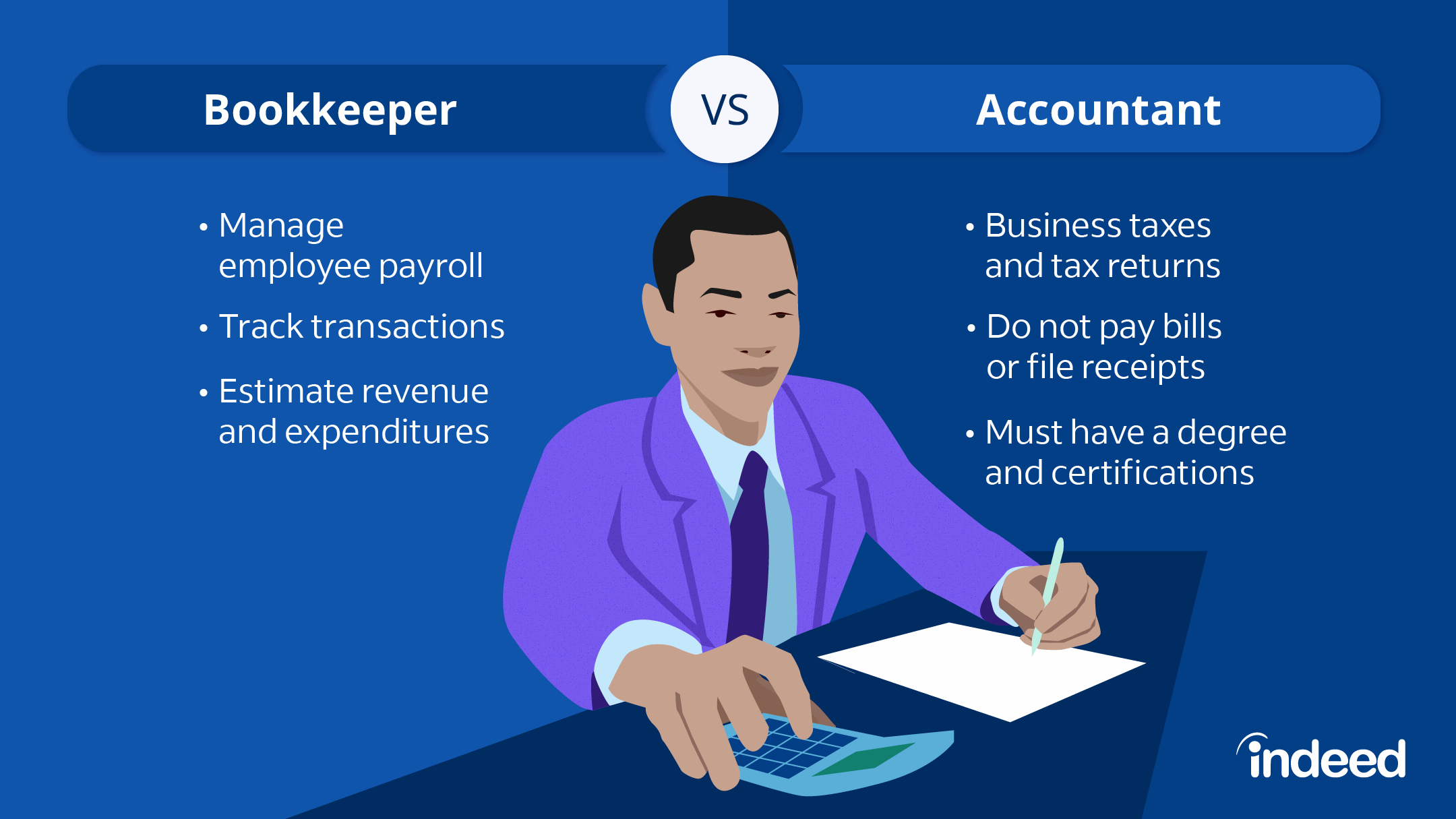

A bookkeeper will cross financial institution statements with internal records at least once a month to find mistakes or inconsistencies. Called bank reconciliation, this process guarantees that the financial records of the firm match those of the bank.

They keep track of current payroll data, subtract tax obligations, and number pay ranges. Bookkeepers create standard economic reports, including: Profit and Loss Declarations Reveals profits, webpage costs, and web revenue. Balance Sheets Lists assets, responsibilities, and equity. Capital Declarations Tracks money movement in and out of business (http://169.48.226.120/www.hirestonewell.com). These reports help entrepreneur recognize their financial placement and make educated choices.

Stonewell Bookkeeping Fundamentals Explained

The ideal selection depends upon your budget plan and company needs. Some local business proprietors like to manage bookkeeping themselves utilizing software. While this is cost-effective, it can be time-consuming and vulnerable to mistakes. Tools like copyright, Xero, and FreshBooks allow organization proprietors to automate bookkeeping tasks. These programs aid with invoicing, bank reconciliation, and economic coverage.

Report this wiki page